Understanding Jumbo Loan: What You Need to Know for Luxury Home Purchases

Understanding Jumbo Loan: What You Need to Know for Luxury Home Purchases

Blog Article

The Influence of Jumbo Car Loans on Your Funding Alternatives: What You Need to Know Before Using

Jumbo financings can play a critical function in forming your financing choices, particularly when it comes to obtaining high-value residential properties. Understanding the equilibrium in between the difficulties and benefits positioned by these lendings is important for prospective borrowers.

Comprehending Jumbo Finances

Recognizing Jumbo Loans needs a clear grasp of their one-of-a-kind qualities and needs. Big fundings are a kind of home loan that goes beyond the conforming loan restrictions developed by the Federal Real Estate Finance Firm (FHFA) These restrictions vary by place yet typically cap at $647,200 in many locations, making jumbo fundings crucial for funding higher-priced residential or commercial properties.

Among the specifying features of jumbo fundings is that they are not qualified for acquisition by Fannie Mae or Freddie Mac, which results in more stringent underwriting standards. Borrowers must often demonstrate a greater credit scores rating, commonly above 700, and offer significant documentation of revenue and properties. In addition, loan providers might need a larger deposit-- often 20% or even more-- to mitigate danger.

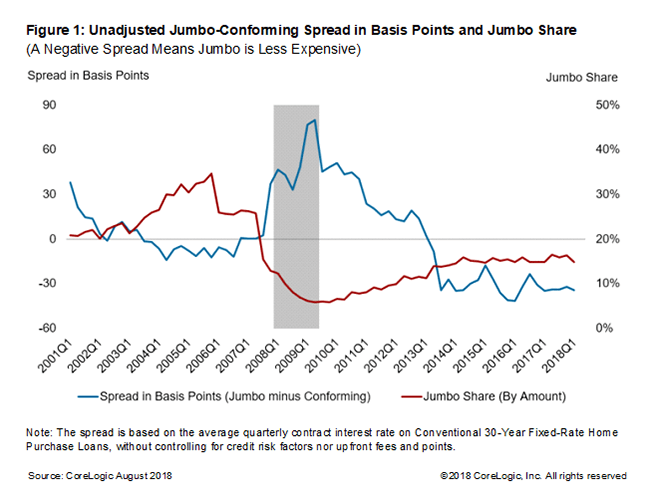

Interest rates on big financings can be a little more than those for conforming fundings as a result of the enhanced threat assumed by the lender. Nonetheless, the absence of personal home loan insurance coverage (PMI) can counter some of these expenses. Understanding these aspects is critical for potential debtors, as they considerably influence the terms and usefulness of securing a jumbo loan in today's affordable property market.

Advantages of Jumbo Loans

Jumbo loans provide unique benefits for buyers seeking to acquire high-value buildings that go beyond standard finance limitations. One of the primary advantages of big financings is their capacity to fund larger quantities, allowing buyers to obtain homes in costs markets without the restraints enforced by adhering financing limits - jumbo loan. This versatility makes it possible for property buyers to view a wider variety of properties that may better fit their choices and needs

Furthermore, big loans typically come with affordable rates of interest, particularly for debtors with solid credit accounts. This can result in substantial cost savings over the life of the financing, making homeownership more cost effective in the long run. In addition, big fundings can be tailored to fit individual financial circumstances, providing different terms and amortization choices that straighten with the debtor's purposes.

Challenges of Jumbo Financings

Navigating the intricacies of jumbo financings offers a number of challenges that prospective consumers need to know before proceeding. One considerable hurdle is the strict lending criteria imposed by banks. Unlike adjusting fundings, big finances are not backed by government-sponsored business, leading lenders to embrace more extensive criteria. This often consists of higher credit report needs and significant documents to confirm income and possessions (jumbo loan).

Additionally, big financings generally feature higher rates of interest compared to standard finances. This raised expense can considerably influence regular monthly payments and general cost, making it crucial for consumers to thoroughly examine their monetary circumstance. The down repayment requirements for big financings can be substantial, commonly varying from 10% to 20% or more, which can be an obstacle for several prospective homeowners.

An additional challenge lies in the minimal availability of big lending items, as not all lending institutions use them. This can bring about a minimized pool of choices, making it important for debtors to perform detailed research study and possibly seek specialized lending institutions. Generally, recognizing these difficulties is essential for anybody taking into consideration a big car loan, as it guarantees informed decision-making and better economic preparation.

Certification Criteria

For those thinking about a big funding, fulfilling the credentials standards is a critical action in the application procedure. Unlike traditional finances, big finances are not backed by federal government agencies, resulting in more stringent needs.

Firstly, a solid credit rating is vital; most lenders need a minimal score of 700. A greater rating not only raises your possibilities of authorization however might additionally secure better rate of interest. In addition, customers are usually anticipated to show a significant earnings to guarantee they can pleasantly manage greater regular monthly payments. A debt-to-income (DTI) ratio below 43% find more information is normally favored, with lower proportions being more positive.

Down payment demands for big loans are likewise considerable. Consumers must anticipate putting down a minimum of 20% of the residential property's acquisition cost, although some loan providers may offer alternatives as low as 10%. Moreover, demonstrating cash money reserves is important; lenders commonly require proof of adequate liquid assets to cover numerous months' well worth of home mortgage payments.

Contrasting Funding Options

When assessing funding choices for high-value residential properties, understanding the differences between different car loan kinds is crucial. Jumbo car loans, which go beyond adjusting financing limitations, generally come with more stringent credentials and greater rate of interest prices than traditional lendings. These lendings are not backed by government-sponsored business, which boosts the lending institution's threat and can cause a lot more rigorous underwriting requirements.

On the other hand, conventional finances supply more flexibility and are often much easier to acquire for debtors with solid credit score accounts. They go to these guys might include lower rate of interest and a broader array of choices, such as dealt with or adjustable-rate home loans. In addition, government-backed car loans, like FHA or VA fundings, supply possibilities for reduced down payments and more tolerant credit rating requirements, though they also enforce restrictions on the funding amounts.

Verdict

In conclusion, jumbo loans existing both possibilities and obstacles for potential buyers looking for financing for high-value residential properties. While these financings permit bigger amounts without the problem of private home mortgage insurance policy, they feature rigid credentials needs and prospective downsides such as greater rate of interest. A thorough understanding of the advantages and difficulties related to big lendings is necessary for making educated choices that align with lasting monetary objectives and objectives in the realty market.

Report this page